Bank Foreclosure Timeline

Bank foreclosures cause uncertainty and fear to many homeowners. Without understand of why the bank is foreclosing, what options are available, and the foreclosure timeline, many homeowners may take the approach of hiding from all contact until anyone in the banking or real estate industry. Here at SAHA, we are committed to helping homeowners understand their options when faced with a bank foreclosure so they can make the best decision for their future. There is life beyond a foreclosure notice.

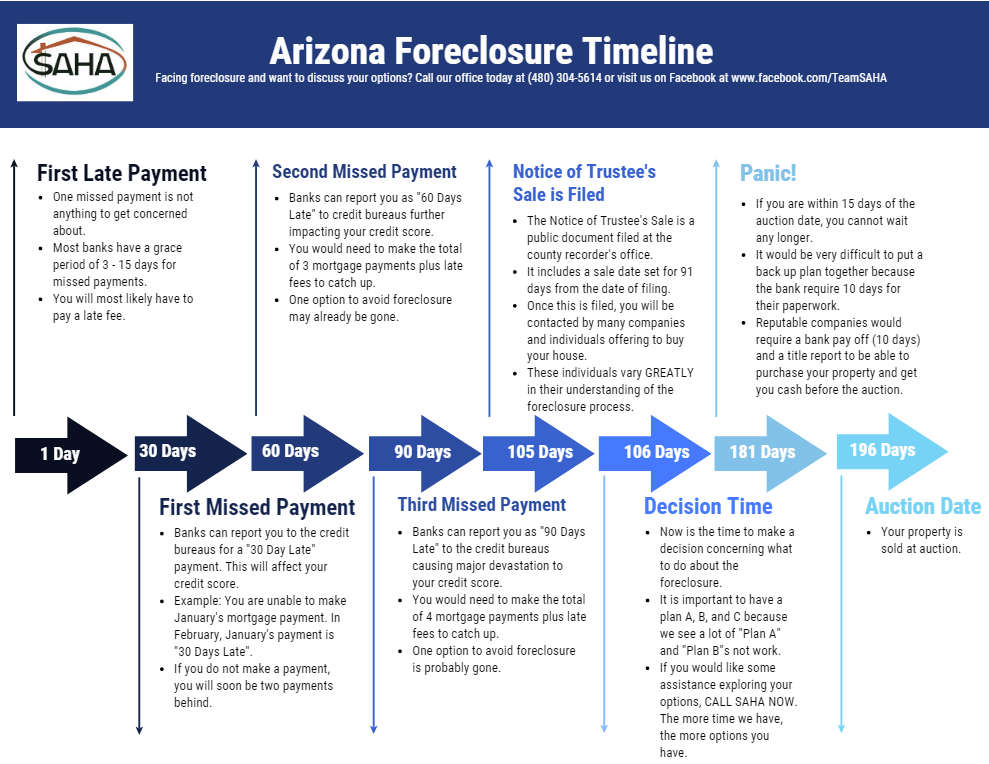

The foreclosure process begins long before the Notice of Trustee’s Sale (a document filed at the country recorder’s office stating information about the foreclosure auction) is filed. It starts with the first missed payment. Most banks have a grace period of 3 – 15 days before there is a late fee added.

When the first missed payment is 30 days late, the account can be reported as late to the credit bureaus as late and it will start to affect the account holder’s credit score. To catch up on payments, the account holder would have to make two mortgage payments plus any late fees the bank charges.

If the account holder does not catch up on payments, they will continue to be marked late to the credit bureaus. The first missed month will be 60 days late. The second missed month will be 30 days late. To catch up on payments, the account holder would have to make three mortgage payments plus any late fees the bank charges.

If another month goes but without payment being made to the bank, the account will be considered 90 days late and could go into foreclosure. To catch up on payments, the account holder would have to make four mortgage payments plus any late fees the bank charges.

The Notice of Trustee’s Sale can be filed after the account is 90 days late. We have seen some bank filed the notice as soon as they are able, other banks wait YEARS to open a foreclosure. It depends on many factors that are not revealed to the public. The auction date is set 91 days from the date of filing.

When the notice is filed, homeowners are contacted by many companies and individuals offering to buy the property. Some of these companies and individuals will educate homeowners on the foreclosure process, some will not. Some will be transparent about their contacts for sale, some will. Some will be able to buy the property, some will not. Homeowners should be very cautious in who they chose to work with during the vulnerable time. Many companies make promises they cannot keep.

Once a homeowner receives the notice of the auction, it is time to make a decision about what they are going to do. It is important to have a Plan A, B, and C. We have seen a lot of “Plan A”s not work. This leaves the homeowner scrambling for help at the last minute. If a homeowner would like some assistance exploring they options, this would the time to call our office and schedule an appointment.

If a homeowner is within 15 days of the auction date, they cannot wait any longer to decide what to do. It would be very difficult to put a back up plan together because the bank requires 10 days to for their paperwork. Reputable companies would require a bank pay off (10 days) and a title report to be able to purchase a property and get the homeowner cash before the auction.

Once the auction date has arrived, it is only a matter of time before someone knocks on the door and informs the former homeowner that they can no longer be in the property.

If you or someone you know is facing a foreclosure and looking for options or has already made the decision to sell, call our office today at (480) 304-5614 to get more information.